First Republic

Student Loan Refinancing

First Republic's student loans provide flexible financing options with competitive rates, making higher education more accessible and manageable for students and their families.

During journey mapping for the Student Loan calculator app redesign, the team identified experiences that didn't quite make the cut for the first iteration, and sales/bank managers were not able to create a lead generation that could turn into potential customers.

Project Details

We focused on the new users, existing customers, and bank managers to understand the pain points and challenges, that users and customers were facing through surveys, interviews, and a set of questionnaires.

Problem

-

Calculator was outdated

-

Overwhelming Information

-

Too many steps for customers leading to frustation

-

Complex Calculator design

-

Time-consuming process

Goal

-

Simple and easy to understand

-

Calculate potential repayment options

-

Provide financial information for informed decisions

Team

-

Brand team

-

Marketing team

-

Product team

-

Technology team

Competitive analysis

We analyzed the 3 most popular student loan refinance calculators on the market. Based on our findings, student loan refinance calculators today are readily available online, but many students hesitate to use them. These calculators often lack user-friendliness, personalization, and clear explanations, making them less appealing to borrowers. Students prefer tools that not only help them understand their options but also provide tailored recommendations to make informed decisions about their student loans.

SoFi Student Loan Refinance Calculator

Pros:

-

User-friendly interface with clear navigation.

-

Personalized rate estimates based on user inputs.

-

Wide range of loan terms and fixed/variable rate options.

-

Features a blog and resource center for financial education.

Cons:

-

Users to create an account to access personalized rates.

-

Limited transparency regarding eligibility criteria.

NerdWallet Student Loan Calculator

Pros:

-

Simple and intuitive design with easy-to-use sliders and inputs.

-

Side-by-side comparisons of multiple lenders.

-

Provides a wealth of educational content related to student loans.

-

No user account for basic calculations.

Cons:

-

Limited customization options for loan terms.

-

Overwhelm users with extensive information.

Credible Student Loan Refinance Calculator

Pros:

-

Streamlined interface with clear instructions.

-

Offers personalized rate estimates without requiring an account.

-

Provides real-time rate comparisons from multiple lenders.

-

Offers a straightforward prequalification process.

Cons:

-

May not offer as many educational resources compared to other platforms.

-

Some users may prefer a more in-depth breakdown of loan details.

Solution

-

The idea behind the new calculator was to streamline the tasks of filling out the information easier and faster.

-

Reduce banner blindness by limiting the amount of copy, and ad blocks that are typical on a calculator page.

-

Keep the information and results on a single page by using an interactive state.

-

Provide Real-time visual responses and results that feel personalized to increase engagement factor.

Wireframe

We began by crafting a concise and well-defined initial draft of a High-fidelity wireframe mapping with a user journey. Our concept centered around implementing an accordion-style form to streamline optional sections. After careful consideration, we settled on a layout structure reminiscent of Nerdwallet's student loan refinance calculator, as it provided the most cohesive user experience compared to competitors. Our design efforts were concentrated on optimizing the information architecture, encompassing:

-

Homepage

-

Micro-experiences

-

Content/Info on the page

-

Redesign Calculator look

-

Redefining Input fields

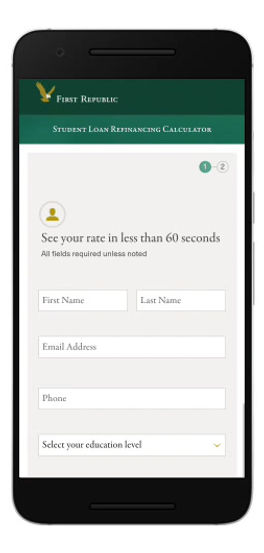

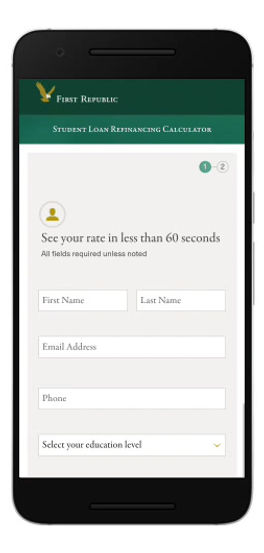

Final Design

We created a simple and easy-to-use Student refinance calculator which was user-friendly and efficient with a minimized number of steps/input for potential customers to provide quick personalized results in less than 60 seconds. The results were based on user data and loan history. I worked closely with UX researchers, branch managers, the marketing team, and developers to develop this tool.

After several rounds of feedback, our stakeholders were impressed with the improved engagement and user experience. As an introductory tool for existing and new clients, the Firsts Republic student loan Refinance calculator surpassed competitors and proved valuable in helping users estimate loan costs and repayment options, empowering them to make informed education financing decisions. It was clearly a major improvement from an engagement and user flow standpoint.